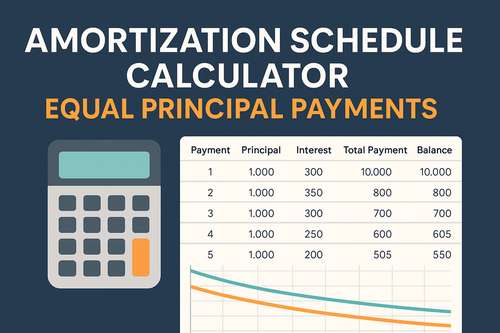

Amortization Schedule Calculator: Equal Principal Payments

An Amortization Schedule Calculator (Equal Principal Payments) divides your loan into a fixed principal portion per payment period. You provide the:

- Loan amount (principal)

- Annual interest rate

- Total number of payments

- Payment frequency: Monthly, Biweekly, Weekly, Quarterly, or Annually

The calculator then:

- Allocates the same principal amount each period.

- Computes interest based on the decreasing remaining balance.

- Displays a schedule showing, for each payment: principal paid, interest paid, and updated remaining balance.

Because the principal portion remains constant, the interest component declines over time. The total payment amount decreases over the loan's life, unlike fixed-payment (EMI) loans where payments stay constant. This structure accelerates principal repayment and lowers total interest expense.

Why It’s Useful

- Transparency: You clearly see how much of each payment goes toward principal versus interest.

- Faster payoff: With fixed principal, interest drops over time, allowing you to pay off faster and save on interest.

- Flexible planning: Choosing different frequencies (e.g., weekly or monthly) lets you understand cash flow needs.

How to Use the Tool: Step‑by‑Step

1. Input Loan Details

- Enter the loan amount, annual interest rate, and total number of payments.

2. Select Payment Frequency

- Options may include Monthly, Biweekly, Weekly, Quarterly, or Annual.

3. Generate Schedule

- The tool calculates equal principal each period and adjusts interest accordingly.

4. Review the Output

- A table lists each payment number, principal portion, interest portion, total payment, and outstanding balance. A chart may also be available.

Sample Illustration

Suppose:

- Loan: $10,000

- Interest rate: 6% per year

- Term: 10 payments

- Frequency: Monthly

Principal per payment = $1,000.

Payment 1 interest = 0.06 / 12 × $10,000 = $50 → Total payment $1,050.

Payment 2 interest = 0.06 / 12 × $9,000 = $45 → Total $1,045.

You’ll see the total payment progressively decrease as interest falls.

Comparing With Equal‑Payment (EMI)

- Equal‑Payment (EMI): Each payment stays the same. Initially, more goes to interest; over time, principal portion increases.

- Equal‑Principal: Principal by itself is fixed each period; interest declines. Total payment decreases. Faster principal payoff and reduced total interest costs.

Try It Now

Ready to take control of your loan planning? Use the Amortization Schedule Calculator with Equal Principal Payments to clearly see how your loan balance decreases over time and how much interest you’re really paying.

Try the calculator now:https://onl.li/tools/amortization-schedule-calculator-equal-principal-payments-49

Comments (0)

No comments yet.

Leave a Comment