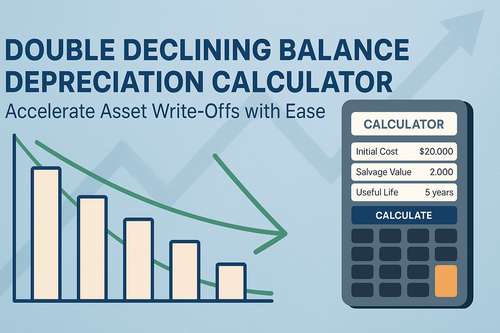

Double Declining Balance Depreciation Calculator: Accelerate Asset Write-Offs with Ease

When it comes to managing your business assets, depreciation is more than just a formality. It plays a critical role in tax planning, financial reporting, and forecasting. One commonly used method for accelerated depreciation is the Double Declining Balance (DDB) method. If you're looking for a straightforward way to apply this method, the Double Declining Balance Depreciation Calculator is a practical tool that can save you time and reduce errors.

What Is Double Declining Balance Depreciation?

The Double Declining Balance method front-loads depreciation expenses. This means that an asset loses value more rapidly in the early years of its useful life, which can help businesses reduce taxable income sooner. It works by:

- Doubling the straight-line depreciation rate

- Applying that rate to the remaining book value each year (excluding salvage value initially)

- Lowering the asset’s book value more quickly than other methods

This is particularly useful for assets that depreciate faster due to usage, technology changes, or wear and tear.

What the Calculator Does

The Double Declining Balance Depreciation Calculator is designed to automate and simplify the entire process. You don’t need to manually compute depreciation year by year or build a custom spreadsheet. The tool provides a detailed annual schedule of depreciation amounts and the declining book value of the asset.

How to Use the Calculator: Step-by-Step Instructions

1. Go to the calculator

Open the tool in your browser:

https://onl.li/tools/double-declining-balance-depreciation-calculator-68

2. Enter the Initial Cost of the Asset

Input the original purchase price or cost of the asset before depreciation. This is the full amount paid, not including salvage value.

3. Enter the Salvage Value

Type in the estimated value of the asset at the end of its useful life. This is the amount you expect to recover after the asset has been fully depreciated.

4. Enter the Useful Life in Years

Specify the number of years you expect to use the asset. This helps determine how many years the calculator will compute depreciation for.

5. Click “Calculate” or “Submit”

Once you’ve entered all the necessary information, click the button to generate your depreciation schedule.

6. Review the Results

The calculator will display:

- The annual depreciation amount for each year

- The asset’s book value at the end of each year

- A full table that makes it easy to track how depreciation progresses

7. Download or Copy Your Schedule

You can copy the results into your records or export them for use in accounting software or reports.

Why Use This Calculator?

- Saves Time: No need to set up formulas or check your math.

- Tax-Friendly: Helps maximize deductions in the early years.

- Easy to Read: Clear tables make the depreciation schedule simple to understand.

- Free and Accessible: No registration or download required.

When to Use It

- Preparing financial statements

- Filing taxes or estimating deductions

- Planning for asset replacement or resale

- Evaluating the impact of capital purchases

Get Started with Your Depreciation Schedule

Whether you’re managing office equipment, vehicles, or other depreciable assets, this tool offers a fast and reliable way to compute accelerated depreciation.

https://onl.li/tools/double-declining-balance-depreciation-calculator-68

Comments (0)

No comments yet.

Leave a Comment