Future Value of 1 Annuity Table (FVIFA): Plan Smarter for Your Financial Future

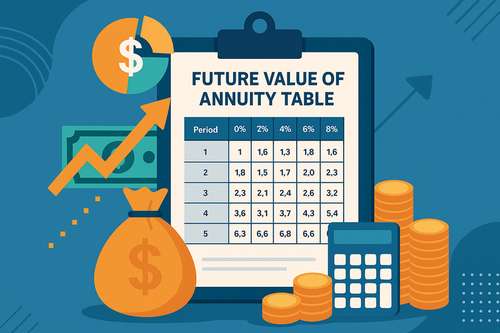

When planning long-term savings or evaluating recurring investments, estimating the future value of your money is essential. The Future Value of 1 Annuity Table (FVIFA) helps simplify this process by providing a fast and accurate way to calculate the total value of a series of equal payments made over time, factoring in a fixed interest rate.

What Is FVIFA?

FVIFA stands for Future Value Interest Factor of an Annuity. It represents the value, at a future date, of a series of regular payments (such as monthly deposits), assuming they are invested at a fixed interest rate. Instead of calculating each payment separately, FVIFA provides a single multiplier. You just multiply this value by the amount of your recurring payment to find the total future value.

Formula:

FVIFA=r(1+r)n−1/r

Where:

- r is the interest rate per period

- n is the number of periods

How to Use the FVIFA Tool

To calculate the future value of your annuity using the FVIFA Table Calculator, follow these steps:

1. Go to the Tool Page

Open the calculator here: FVIFA Calculator

2. Enter the Interest Rate

Use the dropdown or text field to select the interest rate per period (e.g., 5% annually or 0.4167% monthly).

3. Enter the Number of Periods

Input the total number of periods (e.g., 10 years of monthly payments = 120 periods).

4. View the FVIFA Table

The tool will generate a table of FVIFA values across a range of periods and rates. Locate your combination of interest rate and number of periods to find your FVIFA factor.

5. Multiply by the Payment Amount

Take the FVIFA value from the table and multiply it by the amount of your regular payment. This gives you the total future value of the annuity.

Example:

If you're investing $200 monthly for 5 years at 6% annual interest (0.5% monthly), the FVIFA might be around 66.4388.

200×66.4388=$13,287.76200 imes 66.4388 = $13,287.76200×66.4388=$13,287.76

Practical Uses

- Retirement Savings – Estimate how much monthly contributions will grow by retirement.

- College Funds – Plan long-term education savings.

- Business Planning – Evaluate consistent investments in growth or operations.

Take Control of Your Long-Term Finances

Use this tool to make better financial decisions and see how your recurring payments can grow over time. Simple, fast, and effective.

https://onl.li/tools/future-value-of-1-annuity-table-fvifa-78

Comments (0)

No comments yet.

Leave a Comment