Know the Real Cost of Borrowing: How to Use an APR Calculator Effectively

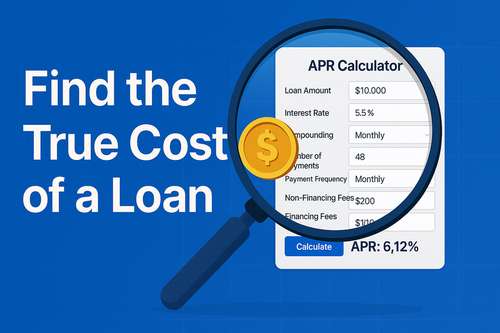

Understanding the cost of a loan goes beyond just looking at the interest rate. Fees, compounding methods, and payment schedules all impact what you’ll actually pay over time. That’s where an APR (Annual Percentage Rate) calculator becomes essential.

This guide walks you through what the APR Calculator does, why it matters, and how to use it effectively—especially when comparing loan offers.

What Is an APR Calculator?

The APR Calculator is a tool that helps you figure out the total yearly cost of borrowing money. It factors in not only the interest rate, but also all fees and charges tied to the loan. This gives you a clearer picture of the actual cost than just the stated interest rate alone.

It’s especially helpful for:

- Comparing loan offers with different fee structures

- Estimating how much you’ll actually pay per year

- Avoiding surprises from hidden charges

What Makes This Calculator Comprehensive?

Most basic loan calculators only show the monthly payments based on the loan amount and interest rate. The APR Calculator goes further by including:

- Loan amount

- Stated interest rate

- Compounding frequency

- Number and frequency of payments

- Three types of fees:

- Non-financing fees (e.g., document fees)

- Financing fees (e.g., loan origination fees)

- Prepaid financing fees (e.g., points paid upfront)

This broader input set gives a much more accurate annualized percentage rate, which you can use to compare any type of loan—from mortgages to auto loans to personal credit lines.

Step-by-Step: How to Use the APR Calculator

1. Enter the loan amount

This is the principal, or the total amount you’re borrowing.

2. Set the interest rate

Input the nominal annual interest rate provided by the lender.

3. Choose the compounding frequency

Monthly compounding is typical, but some loans may use daily or quarterly compounding.

4. Input the number of payments and payment frequency

This could be monthly payments over 36 months, biweekly over 5 years, etc.

5. Add fees if applicable

Include any upfront or built-in charges associated with the loan. These influence the APR significantly.

6. Calculate

The calculator then generates the APR based on all the above data—presenting a more reliable figure than the interest rate alone.

Why APR Matters

APR is a standardized measure that lets you compare the true cost of borrowing from one lender to another, even when the interest rate and fees vary. It levels the playing field by taking everything into account.

For example:

- Loan A has a 4.5% interest rate and no fees.

- Loan B has a 4.2% interest rate but includes $500 in fees.

Although Loan B looks better at first glance, the APR Calculator may show that Loan A is actually cheaper overall.

Try the APR Calculator Yourself

Make smarter borrowing decisions with an accurate APR that reflects the full picture.Try our free APR Calculator and take control of your financial planning today:https://onl.li/tools/apr-calculator-51

Comments (0)

No comments yet.

Leave a Comment