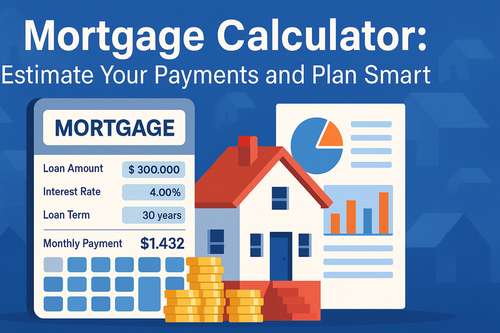

Mortgage Calculator: Estimate Your Payments and Plan Smart

Buying a home is one of the biggest financial decisions most people will make. Whether you're just starting to browse or already house hunting, it’s important to understand how your monthly mortgage payment fits into your budget. That's where a mortgage calculator comes in handy.

What Is a Mortgage Calculator?

A mortgage calculator is a digital tool that helps you estimate your monthly loan payments based on inputs like the loan amount (principal), interest rate, and loan term (length of the loan). Many calculators also allow you to add in expenses like:

- Property taxes

- Homeowner’s insurance

- Private Mortgage Insurance (PMI)

This gives you a more accurate picture of what your full monthly payment will be.

Why You Should Use One

1. Estimate Monthly Payments

At its core, the mortgage calculator tells you what you can expect to pay every month. By adjusting the loan amount or term, you can see how changes affect affordability.

2. Compare Loan Options

Looking at a 15-year mortgage versus a 30-year one? The calculator lets you compare how much you'll pay in interest over time with each option.

3. Visualize an Amortization Schedule

Many tools generate a full amortization table. This breaks down each monthly payment into how much goes toward interest and how much reduces your principal. It shows you how your balance decreases year by year.

4. Avoid Surprises

Factoring in taxes and insurance ensures you're planning for the full cost—not just the base mortgage.

5. Improve Budgeting

Whether you’re trying to determine how much house you can afford or figure out how a down payment affects your future, the calculator supports clearer financial planning.

How to Use the Tool

Using the Mortgage Calculator is simple:

- Enter the loan amount – This is the total amount you plan to borrow.

- Add the interest rate – Use your lender’s rate or a typical market rate.

- Choose the term – Usually 15, 20, or 30 years.

- Include other costs – Enter property tax, insurance, and PMI if applicable.

- View results – The tool will instantly calculate your estimated monthly payment and show an amortization schedule.

What You Get

Our tool stands out for its clarity and detail. It includes:

- An interactive chart that breaks down payment components.

- A running total of interest paid over time.

- Dynamic results that update instantly as you change inputs.

- A printable schedule you can save or share with a lender.

It’s ideal for first-time buyers and current homeowners alike who want to understand their financing better before making decisions.

Try the Mortgage Calculator Now

Take control of your homebuying journey and see how different loan options impact your payments.

Comments (0)

No comments yet.

Leave a Comment