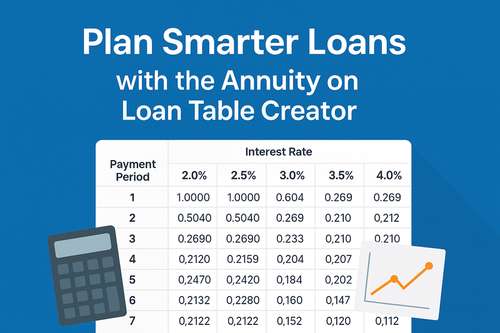

Plan Smarter Loans with the Annuity on Loan Table Creator

The Annuity on Loan Table Creator is a practical online tool that generates detailed annuity payment tables for loans. By inputting adjustable interest rates and payment periods, the tool helps you model how loan payments change across scenarios, supporting better loan decisions and long-term planning.

Step‑by‑Step Guide to Using the Tool

1. Choose Your Interest‑Rate Range (Columns)

- Define how many interest‑rate columns you need (up to 20).

- Input the starting rate and the increment between columns—e.g. start at 3% and add 0.5% per column.

This lets you map how different rates influence payments.

2. Define Payment Periods (Rows)

- Specify the number of row periods (up to 50).

- Enter the starting period (like 1 year or 1 month) and the increment between each.

This might be year‑by‑year or in steps (for example, every 2 or 5 years).

3. Select Annuity Type (if provided)

- Some implementations allow choosing between an ordinary annuity (payments at the end of each period) or an annuity due (payments at the beginning).

This choice affects the calculation because annuity‑due payments are compounded one period earlier.

4. Generate Your Table

- Click Create Table or Calculate, and the tool outputs a matrix of annuity factors or payment amounts for each combination of interest rate and length.

- Each cell shows the annuity payment per $1 of principal, based on the formula:

PMT=i×(1+i)n−1(1+i)n

where i is rate, n is periods

Using the Table: Real‑World Scenarios

- Loan comparisons: See how payments rise or fall for fixed term vs extended term, or with different interest rates.

- Budget forecasting: Estimate monthly payments for varying terms to align with income or cash‑flow needs.

- Financial planning: Incorporate early termination or rate‑increase risk into amortization modeling.

Example Setup

Suppose you want a table showing payments per $1,000 over terms of 1–10 years at rates from 2% to 6%:

This gives a table of factors like 0.2122 at 5%/5‑year, meaning $1,000 × 0.2122 ≈ $212.20 annual payment.

Why This Tool Is Useful

- Flexible scenario exploration — Test many variations of rates and terms quickly.

- Helps visualize trade‑offs — Balance longer terms/low rates vs shorter terms/higher payments.

- Transparent calculation — Based on standard annuity formulas; no surprises or hidden assumptions.

- Supports financial literacy — Easy to teach or learn how rate or time changes affect cost.

Tips & Best Practices

- Confirm payment frequency (monthly vs annual). Adjust rate and periods accordingly.

- Use consistent units (e.g. all in years or months).

- Interpret table values correctly. Factors are per $1 – multiply by loan amount for actual payments.

- Validate results against known formula or amortization tables if used for high‑stakes decisions.

Try It Yourself

Ready to explore how different loan terms and rates affect your payments?

Use the Annuity on Loan Table Creator now:

https://onl.li/tools/annuity-on-loan-table-creator-50

Experiment with your own values and generate custom annuity tables in seconds. It’s free and easy to use.

Comments (0)

No comments yet.

Leave a Comment