Reverse Sales Tax Calculator: Understand What You Really Paid For

When reviewing a receipt or trying to reconcile an invoice, you might want to know how much of the total you paid was actual cost and how much was tax. That’s exactly what the Reverse Sales Tax Calculator helps you figure out.

What Does the Reverse Sales Tax Calculator Do?

The Reverse Sales Tax Calculator is a simple tool that works backward from a total purchase amount. If you only know the total amount paid and the sales tax rate, the calculator helps you:

- Determine the pre-tax (original) price

- Find out the exact amount of sales tax paid

This can be useful for budgeting, auditing, or simply understanding where your money went.

How It Works

Using the calculator is straightforward:

- Enter the total price (this is the final price you paid, including tax).

- Input the sales tax rate (for example, 8.25%).

- The calculator will output:

- The original price before tax

- The amount of tax that was added

This tool takes the guesswork out of separating the base cost from the tax, which is especially helpful for businesses, freelancers, or anyone doing expense tracking.

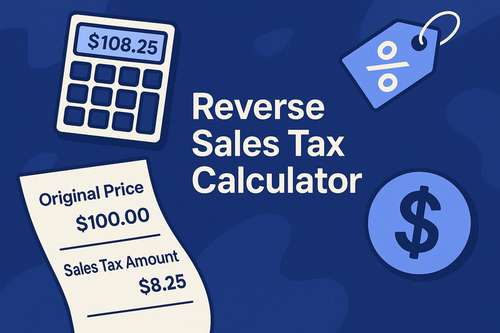

Example

Let’s say you bought something for $108.25, and your local sales tax rate is 8.25%. Plug that into the calculator, and it will show:

- Original price: $100.00

- Sales tax amount: $8.25

Simple, clear, and helpful.

Tool Features and Interface

The Reverse Sales Tax Calculator offers:

- A clean and responsive layout

- Instant calculation results as you type

- Easy-to-follow input fields

- Compatibility with both desktop and mobile browsers

There’s no learning curve, and no downloads are required.

Who Should Use This Tool?

This tool is helpful for:

- Shoppers who want to check how much tax they paid

- Small business owners reconciling receipts or preparing reports

- Freelancers and contractors managing tax-inclusive pricing

- Educators and students learning about tax calculations

Get Started

Try the tool now and see how easy it is to break down a total price into its components.

Comments (0)

No comments yet.

Leave a Comment