Rule of 72 Calculator: Estimate Doubling Time or Interest Rate with Ease

If you’ve ever wondered how long it would take for your money to double with a fixed interest rate—or what interest rate you’d need to double your money in a certain amount of time—the Rule of 72 Calculator is a tool worth using. It's a fast and simple way to make rough financial forecasts without needing a spreadsheet or complicated math.

What Is the Rule of 72?

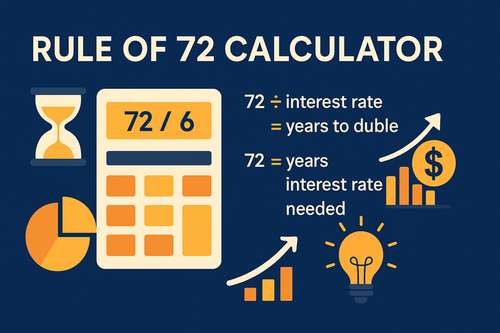

The Rule of 72 is a quick formula used in finance to estimate how long it takes for an investment to double, based on a fixed annual rate of return. You divide 72 by either the interest rate (to get years) or the number of years (to get the required rate).

1. To find the doubling time:

72 ÷ annual interest rate = years to double

2. To find the required interest rate:

72 ÷ number of years = annual interest rate needed

This rule offers a helpful shortcut for understanding compound interest and comparing investment options at a glance.

How the Rule of 72 Calculator Works

The Rule of 72 Calculator makes using this formula even easier. You just plug in one value and let the calculator do the rest.

You can:

- Enter an interest rate to find out how many years it will take to double your investment.

- Enter a number of years to find the interest rate required to double your money in that timeframe.

It’s useful for:

- Planning savings goals

- Understanding the impact of compounding

- Comparing investment opportunities

- Doing quick mental math during financial discussions

Example Uses

1. You have a savings account with a 6% annual return.

72 ÷ 6 = 12 years to double your money.

2. You want your investment to double in 9 years.

72 ÷ 9 = 8% annual return needed.

These quick insights are especially handy when evaluating financial choices or teaching financial literacy.

Limitations to Keep in Mind

The Rule of 72 is a rough estimate. It assumes:

- A constant annual rate of return

- Annual compounding (not monthly or daily)

- No additional contributions or withdrawals

While it’s not perfect for detailed forecasting, it’s a reliable first step when making general plans or comparing options.

Try the Calculator for Yourself

Ready to estimate your investment growth or compare interest rates? Use the Rule of 72 Calculator now:

Comments (0)

No comments yet.

Leave a Comment